Forward Volatility Discount

Risk.net

Fixed income relative value (RV) strategies have come a long way since we first started trading them more than 30 years ago. Back then a Treasury bond future was considered a complicated derivative and buying a bond and making delivery into the futures contract was deemed an exotic arbitrage strategy. The market was focused on duration and RV trading was constrained to a few instruments and a narrow set of strategies.

Today, the world of fixed income RV trading is substantially more complex.

The set of tradable instruments has expanded to include interest rate swaps, basis swaps, total return swaps and constant maturity swaps to name just a few. Meanwhile, a liquid options market has developed for virtually all the different asset classes within fixed income.

RV trading is the cornerstone of III Associates' investment philosophy and the vast majority of our strategies have little or no directionality associated with them. However, having tools to manage the directionality that may occur in the portfolio is critical.

Options can play an effective role in managing risk. Options strategies that are familiar to equity investors, such as covered call writing and risk reversals, can also be easily implemented in the fixed income markets. Moreover, options can be traded in numerous markets, including government bonds, mortgage-backed securities and interest rate swaps.

The mass proliferation and increased liquidity of the exchange-traded funds (ETF) market has led to the emergence of ETF options on less liquid markets including municipal bonds, investment-grade and high yield corporates and emerging markets debt. Option liquidity in some of these ETF markets has yet to reach levels that are satisfactory to institutional investors but that is likely to change over time as more institutional investors embrace ETFs.

The vanilla and exotic option markets allow fixed income traders to customise desired exposures, while simultaneously controlling downside risk. Used correctly options can significantly improve the risk/reward trade-off in fixed income RV strategies.

For instance, compare the benefits of ‘conditional curve trades' to traditional yield curve strategies. A conditional curve trade expresses a view on the shape of the curve within a specific interest rate regime. This means a trader can take a position that the curve will be steep between two points if interest rates remain low, even if he has less confidence in the outcome if interest rates rise.

The trade is implemented by purchasing a receiver swaption on the shorter rate and selling a receiver swaption on the longer rate. This provides isolated exposure to a low interest rate environment.

The receiver options will only pay out when interest rates have fallen below a certain level or strike at the maturity of the option. The options expire worthless if rates are above the strike rate at option expiry.

This means there is no exposure to the shape of the curve if rates are higher than the strikes of the options but if rates are below the strikes, the sought after curve steepening exposure kicks in.

This conditional structure is superior to a traditional yield curve trade, which is generally structured through bonds or interest rate swaps, both of which maintain their curve exposure regardless of the interest rate environment. This unconditional exposure means the portfolio could suffer unlimited losses should a higher rate environment and a flatter curve relationship develop.

Hedging against this potential outcome requires adding stop-loss strategies to mitigate losses. However this means the manager is reliant on continuous, liquid markets to exit a position in an adverse scenario.

While most fixed income option strategies can be classified as relative value or directional in nature, some hybrid options allow managers to express a directional view by taking advantage of RV opportunities. An example of this type of strategy would be a ‘dual digital option'.

A dual digital option has a payoff that is linked to two events, rather than just one, occurring at option maturity. If a portfolio manager expects or needs to hedge against a fall in the 10-year swap rate over the next six months due to a flight to quality rally in the market resulting from bank funding concerns and stress on Libor rates, a six-month receiver swaption can be purchased to gain the desired exposure.

Alternatively, linking the two events through the use of dual digital options in which both events must occur to receive a payout (10-year swap rates must fall and three-month Libor rate must rise) could reduce the cost of the option by more than 50%.

The lower option premium effectively increases the payout and leverage on the option. High implied correlation is the reason that an option requiring two events to occur before a payout trades cheaper than an option that is contingent on a single event. The market assumes a high probability of interest rates across the curve rising and falling together.

If 10-year rates go down, the probability is that three-month rates will also go down. To the extent that a manager thinks the market is mispricing correlation, these types of options can have tremendous value.

Options are used to express both directional views and RV plays on interest rates but they can also be used to express relative value on volatility itself.

Many investors consider volatility a separate investable asset class and there are plenty of pure-play options strategies available in the fixed income market. For example, examine the difference between a Bermudan swaption (an option with multiple exercise dates) and a European swaption (an option with a single exercise date). The supply and demand characteristics for Bermudan volatility are very different from the supply and demand of European volatility.

Strategies that involve going long one option and short the other can be structured to provide excellent pay-off potential under various scenarios. Keep in mind that these options reference the same underlying market: the only difference being all the additional chances to exercise in the Bermudan.

Options also play a key role in securing downside protection in the form of tail hedges. The best type of tail protection comes from buying out-of-the-money options that have the potential to have a magnified pay-off under certain scenarios. Many market participants think of out-of-the-money equity puts as the only available alternative to protect a multi-asset portfolio from systemic risk.

These options may be suitable for an equity portfolio but for a fixed income RV portfolio, the options should be customised to the interest rate markets to ensure the hedge is correlated with the risks imbedded in the portfolio.

For example, options can be traded on swap spreads, curve shape, forward interest rates, forward volatility and so on. This means the hedge can truly be customised.

While some of the choices may not have relative value from a pricing perspective, most will certainly have excellent value in terms of effectiveness. The best hedging strategies will possess both a high correlation to market disruption and attractive relative value.

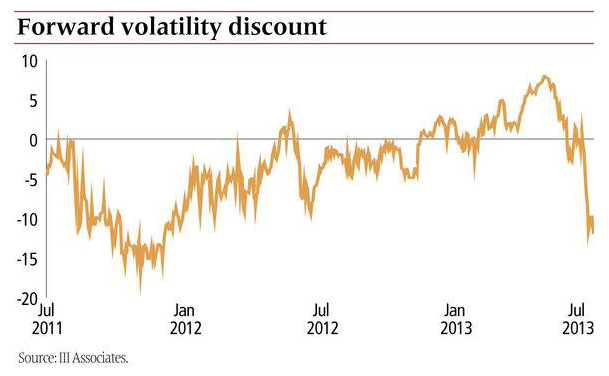

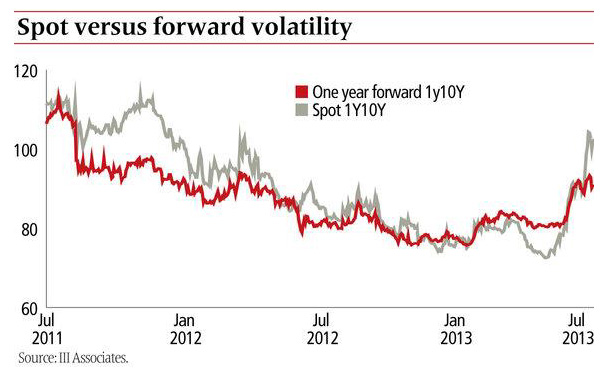

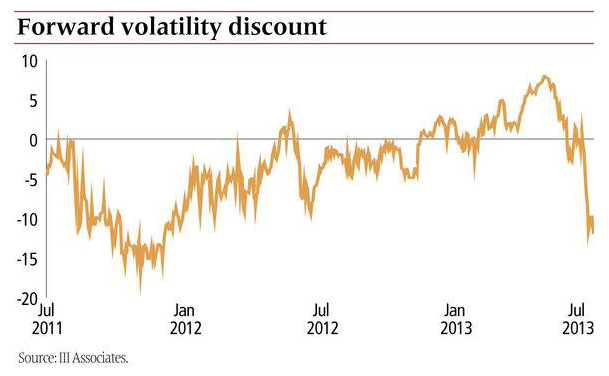

For example, the market occasionally allows traders to buy interest rate volatility in the future at a significant discount to spot levels. This 'warehousing' of volatility is a defensive strategy that can be incorporated into portfolios. Both the dollar value of the potential pay-off and the option premium at risk can be determined with a high degree of certainty.

Another key element to consider whenever any option strategy or strategies are used is theta management. A portfolio of exclusively long option positions will experience premium erosion over time, or negative theta. This negative theta can be managed by choosing options of different maturities and strikes. However, the holding costs will still be negative.

From an RV perspective the trade-off is whether to incur this negative carry in exchange for the benefits of having a defined risk position: that is, the risk management benefits must exceed the incremental holding costs. Otherwise, the exposure may be better obtained via the outright market rather the options market.

Supplementing long option positions with short option positions is often a good way to reduce the impact of negative theta. So rather than just buying a call option or a put option, a call spread or a put spread may offer better value from a holding cost perspective.

A short option position with a strike further out-of-the money paired with a long option position on the same underlying and with the same expiration date merely caps the potential payout on the long option rather than exposing the portfolio to the potential for unlimited losses. The out-of-the money options may also be trading relatively rich to options struck closer to spot levels, further lowering the cost of the trade.

The ability to trade options in a variety different fixed income markets has increased the choices available to managers. The use of options strategies in fixed income RV portfolios can improve a manager's ability to control downside risk while preserving the opportunity to take advantage of most market dislocations.

The future of fixed income RV trading may belong to managers that master the use of option strategies to increase payout potential if their anticipated events occur as well as to reduce their downside risk if they do not.

Garth Friesen, a principal and co-chief investment officer of III Associates, wrote this article.